Authors present the agenda of the ‘just transition’ as “offering investors a range of opportunities for implementing a comprehensive approach to climate action in tune with the overarching objective of sustainable development. By including the just transition in their climate strategies, investors can not only tackle the challenge of ‘stranded assets’ but also of ‘stranded workers’ and ‘stranded communities’. Such action looks set to be a critical part of the way in which investors can help to accelerate the transition to a zero-carbon economy and thereby support the development of a more efficient, effective and sustainable global financial system.”

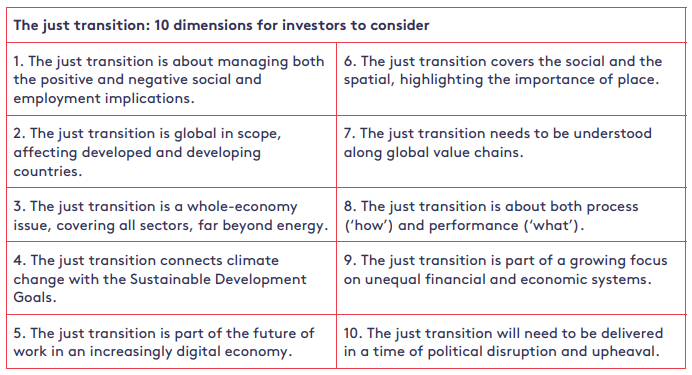

The report identifies 10 strategic dimensions of the just transition:

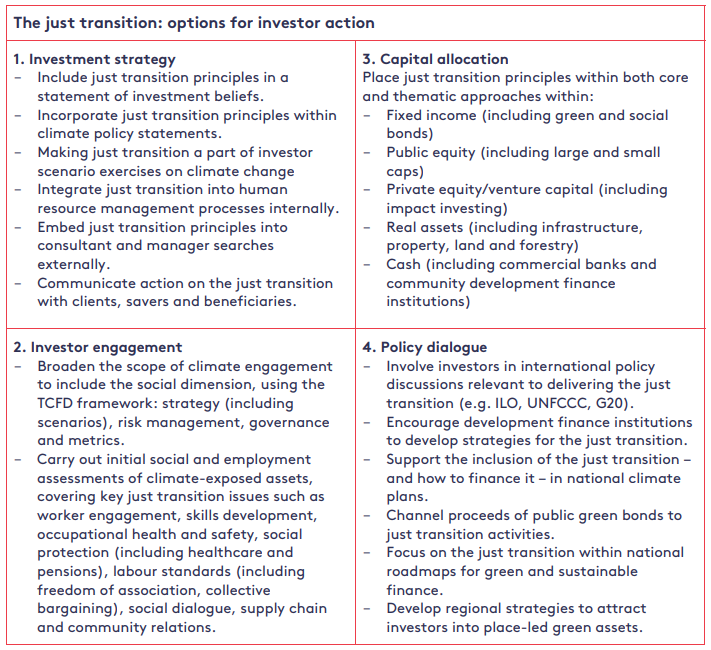

Authors suggest four main ways in which investors could take action to promote the just transition, which all build on established practices: